Bookkeeping and Accounting Services for Business Owners

admin

- 0

Running a successful business is not just about offering great products or services, but also about effectively managing your finances. Maintaining accurate records of your financial transactions is essential for making informed decisions and ensuring compliance with tax regulations. This is where bookkeeping and accounting services come into play.

What is Bookkeeping?

Bookkeeping is the process of recording, organizing, and maintaining financial data for a business. It involves keeping track of all the financial transactions, including sales, purchases, receipts, and payments. Bookkeeping ensures that all financial data is accurately recorded and can be used to generate reports, track expenses, and aid in decision-making.

Why is Bookkeeping Important for Business Owners?

Accurate and up-to-date bookkeeping is crucial for several reasons: Financial Analysis: Proper bookkeeping allows business owners to analyze their financial health accurately. It helps identify trends, track expenses, and monitor cash flow. These insights are vital for making strategic business decisions. Tax Compliance: Bookkeeping provides the necessary information for preparing tax returns and ensuring compliance with tax laws. It helps calculate accurate tax liabilities, claim eligible deductions, and minimize the risk of penalties or audits. Budgeting and Forecasting: By maintaining accurate records of income and expenses, bookkeeping enables business owners to create realistic budgets and forecast future financial needs. Investor Confidence: Investors and lenders often require access to reliable financial records before providing capital. Well-organized bookkeeping enhances credibility and instills confidence in potential investors. Better Decision-making: Access to timely and accurate financial information allows business owners to make informed decisions about pricing, resource allocation, and investment opportunities.

What are Accounting Services?

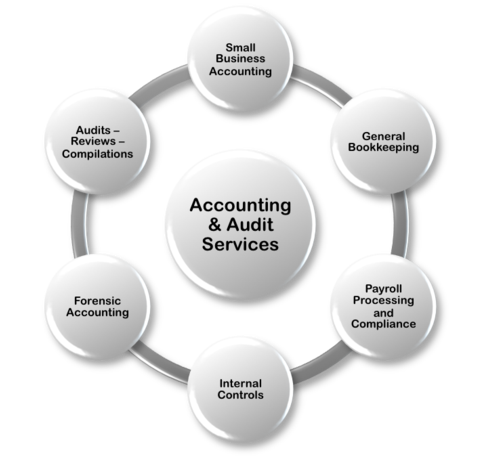

Accounting services build upon the foundation of bookkeeping and provide additional financial analysis and reporting. While bookkeeping focuses more on data entry and record-keeping, accounting offers a broader understanding of your business’s financial position.

The Benefits of Outsourcing Bookkeeping and Accounting Services

Outsourcing bookkeeping and accounting services can be highly advantageous for business owners. Some key benefits include: Expertise and Accuracy: Professional bookkeepers and accountants possess the necessary expertise in financial management and ensure accuracy in record-keeping. Their knowledge of accounting principles and best practices reduces the risk of errors and financial discrepancies. Cost Savings: Outsourcing these services eliminates the need to hire and train an in-house accounting team, saving on recruitment, salaries, and employee benefits. Additionally, outsourcing allows you to pay only for the services you require, resulting in cost efficiency. Focus on Core Business Activities: By delegating bookkeeping and accounting tasks to professionals, business owners can focus on their core competencies and strategic goals, leading to increased productivity and growth. Data Security: Reputed bookkeeping and accounting service providers prioritize data security. They employ robust security measures, such as encrypted data storage and access controls, protecting your business’s sensitive financial information. Scalability: As your business grows, your financial requirements become more complex. Outsourcing allows you to easily scale up or down the services you need, ensuring flexibility and adaptability. Latest Industry Knowledge: Professional bookkeepers and accountants stay updated with the latest accounting regulations, tax laws, and industry practices. This knowledge ensures your business remains compliant and takes advantage of relevant tax deductions or incentives.

Choosing the Right Service Provider

When selecting a bookkeeping and accounting service provider, consider the following factors: Experience and Expertise: Look for providers with extensive experience in your industry and a track record of delivering reliable services. Range of Services: Assess your business’s specific needs and ensure the service provider offers the comprehensive services you require, including financial statements, tax preparation, payroll, and financial analysis. Technology and Tools: Inquire about the software and technologies they use. Ideally, they should employ robust accounting software and provide you with easy access to your financial data. Customer Support: Prompt and helpful customer support is crucial. Ensure that the service provider offers responsive assistance whenever you have queries or need assistance with your financial records. Security Measures: Ask about their data security protocols to ensure that your financial information remains secure and protected from unauthorized access or data breaches. Cost Structure: Obtain detailed information about their pricing structure, billing frequency, and any additional fees for specific services. Compare it with other providers to ensure the best value for your money.

Conclusion

Bookkeeping and accounting services play a vital role in the financial management of businesses. By maintaining accurate records, analyzing financial data, and providing valuable insights, these services help business owners make informed decisions and ensure compliance with tax regulations. Outsourcing these services can be a cost-effective and efficient solution, allowing businesses to focus on their core activities while benefiting from professional expertise. By carefully choosing a reliable service provider, business owners can enhance their financial management practices and set their businesses on a path to success.